working capital turnover ratio meaning

The working capital turnover ratio is calculated as follows. Working capital turnover refers to a ratio providing insights as to the efficiency of a companys use of its working capital to run the business and scale.

Working Capital Estimation Operating Cycle Method Learn Accounting Accounting Education Accounting And Finance

Working capital turnover ratio is computed by dividing the net sales by average working capital.

. The ratio indicates how effectively a company uses available funds for the streamlined production of goods or services. The intent is to measure the proportion of revenue that a company can generate with a given amount of equity. The working capital turnover ratio is also referred to as net sales to working capital.

High turnover ratios can mean that the. The working capital turnover ratio measures how well a company is utilizing its working capital to support a given level of sales. Working capital turnover is defined as a ratio that measures how effectively a company utilizes its working capital to support its sales and revenue growth.

Capital turnover compares the annual sales of a business to the total amount of its stockholders equity. It is a measure of the ability of a business to use its working capital to support its turnover or revenues. Working capital is current assets minus current liabilities.

The working capital turnover ratio measure the efficiency with which the working capital is being used by a firm. It measures how efficiently a business turns its working capital into increase sales. Net annual sales divided by the average amount of working capital during the same year.

Generally a working capital ratio of less than one is taken as indicative of potential future liquidity problems while a ratio of 15 to two is interpreted as indicating a company on solid. Working capital is very essential for the business. The ratio is a measurement that defines the relationship between the cost of a companys operations and the corresponding revenue.

20 lakh and average working capital Rs. The working capital turnover ratio shows the connection between the money used to finance business operations and the revenue a business earns as a result. But a very high working capital turnover ratio may also mean lack of sufficient working capital which is not a good situation.

A working capital of five would mean that a company is generating five times its revenue per dollar of working capital. The higher the sales the more the profits and therefore the more. Working Capital Turnover Ratio is an efficiency ratio that measures the efficiency with which a company is using its working capital in order to support the sales and help in the growth of the business.

Working capital turnover is a financial ratio to measure how efficiently companies use their working capital to generate revenue. It shows companys efficiency in generating sales revenue using total working capital available in the business during a particular period of time. The ratio can be used to evaluate the efficiency of a.

Example of Working Capital. Working capital turnover ratio is a formula that calculates how efficiently a company uses working capital to generate sales. The working capital turnover is a ratio to quantify the proportion of net sales to working capital.

Working capital turnover ratio Cost of sales Average net working capital. Where cost of sales Opening stock Net purchases Direct expends - Closing stock. Definition of Working Capital Turnover Ratio.

Capital Turnover Ratio 500000 40000 125 Interpretation It means each of capital investment has contributed 125 towards the sales of the company and this 125 seems that the utilization of capital investment is done efficiently by the company. It is defined as the difference between the current assets and current liabilities and working capital turnover ratio establishes. 4 lakh the turnover ratio is 5 ie.

Note that another ratio exists the Sales to Working Capital Ratio also measures Net Sales to Working Capital. It indicates a companys effectiveness in using its working capital. For instance if a businesss annual turnover is Rs.

The working capital turnover ratio is a ratio of the turnover of the business to its working capital. Net working capital Current assets - Current liabilities. Formula For Working Capital Turnover Ratio Working Capital Turnover Ratio Turnover Net Sales Working Capital.

This ratio answers the question - How much of revenues are generated per dollar of working capital. We chose to interchange the usual components of Working Capital Total Current Assets Total Current Liabilities with an alternate method shown above. Working Capital Turnover Ratio helps in determining that how efficiently the company is using its working capital current assets current liabilities in the business and is calculated by diving the net sales of the company during the period with the.

Working Capital Turnover is a turnover ratio to review revenues over working capital. The Working Capital Turnover ratio measures the companys Net Sales from the Working Capital generated. In principle the working capital turnover or net working capital turnover measures how much money a company required to run the business compared to its ability to generate revenues from operations.

It is also a general measure of the level of capital investment needed in a specific industry in order to generate sales. We calculate it by dividing revenue by the average working capital. Working capital turnover is a ratio comparing the depletion of working capital to the generation of sales over a given period.

The formula consists of two components net sales and average working capital. Working Capital Turnover Ratio is the ratio of net sales to working capital. When companies use the same working capital to generate more sales it means that they are using the same funds over and over again.

Working capital turnover is also known asNet Sales to Working Capital. Average of networking capital. The working capital turnover ratio is also referred to as net sales to working capital.

In this formula working capital refers to the operating capital that a company uses in day-to-day operations. A high turnover ratio indicates that management is being extremely efficient in using a firms short-term assets and liabilities to support sales. This is why this ratio is also called Working Capital Turnover Ratio as it measures the number of times working capital has been turned over.

Net annual sales divided by the average amount of working capital during the same year. A higher ratio indicates higher operating efficiency where every dollar of working capital generates more revenue. A high ratio indicates efficient utilization of working capital and a low ratio indicates otherwise.

The working capital turnover ratio is calculated as follows. What is Capital Turnover. Working capital turnover ratio is the ratio between the net revenue or turnover of a business and its working capital.

It indicates a companys effectiveness in using its working capital.

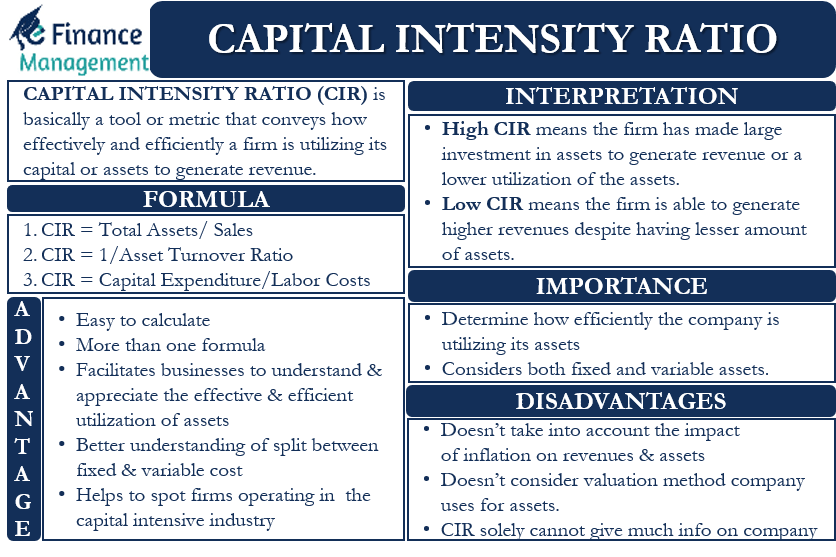

Capital Intensity Ratio Meaning Formula Importance And More

Working Capital Turnover Ratio Formula Calculator Excel Template

Working Capital Turnover Efinancemanagement Com

Recapitalization Money Management Advice Accounting Education Accounting And Finance

Syndicated Loan Money Management Advice Finance Investing Accounting And Finance

Working Capital Turnover Ratio Interpretation College Adventures Ratio

Payable Turnover Ratio Meant To Be Details Meaning Interpretation

Key Performance Indicators Kpis All You Need To Know Key Performance Indicators Financial Analysis Critical Success Factors

Capital Turnover Definition Formula Calculation

Working Capital Estimation Operating Cycle Method Learn Accounting Accounting Education Accounting And Finance

Contribution Margin Vs Operating Margin Operating Margin Contribution Margin Financial Analysis

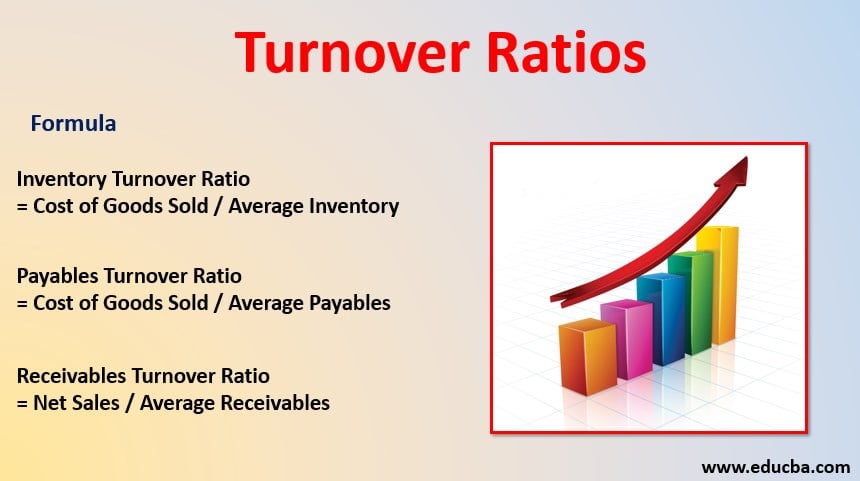

Turnover Ratios Example Explanation With Excel Template

Capital Structure Theory Modigliani And Miller Mm Approach Social Media Optimization Accounting And Finance Financial Management

Advantages And Disadvantages Of Incremental Budgeting Budgeting Accounting And Finance Accounting Basics

What Is A Good Inventory Turnover Ratio Bookkeeping Business Inventory Turnover Accounting Education

4 Best Financial Ratio Analysis Technique Discussed Briefly Educba Financial Ratio Trade Finance Financial Analysis