inheritance tax rate kansas

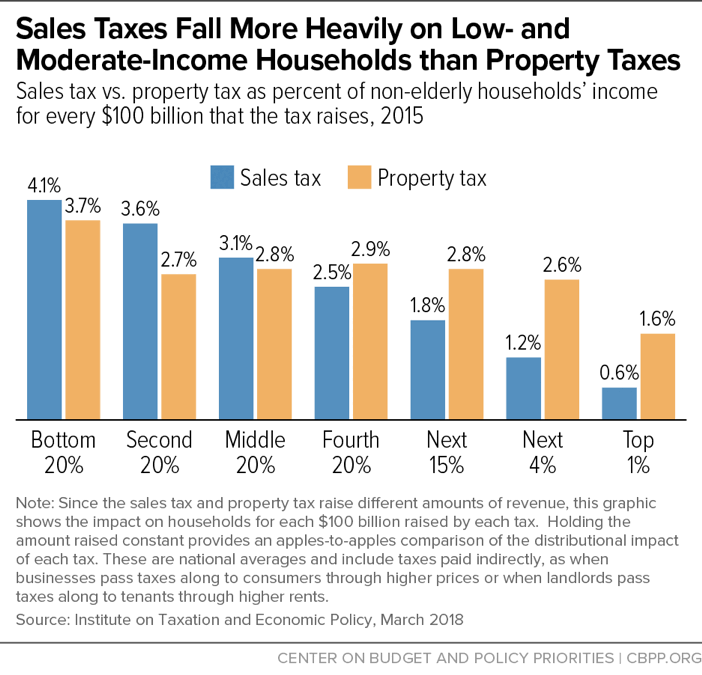

Also the United States also does not impose an income tax on inheritances brought into the United States. The lower ones income the higher ones overall effective state and local tax rate.

South Carolina Tax Rates Rankings Sc State Taxes Tax Foundation

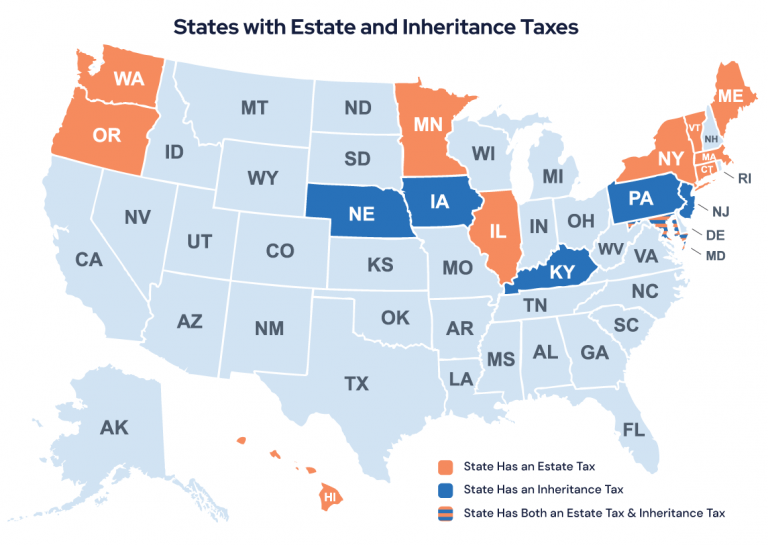

Twelve states and Washington DC.

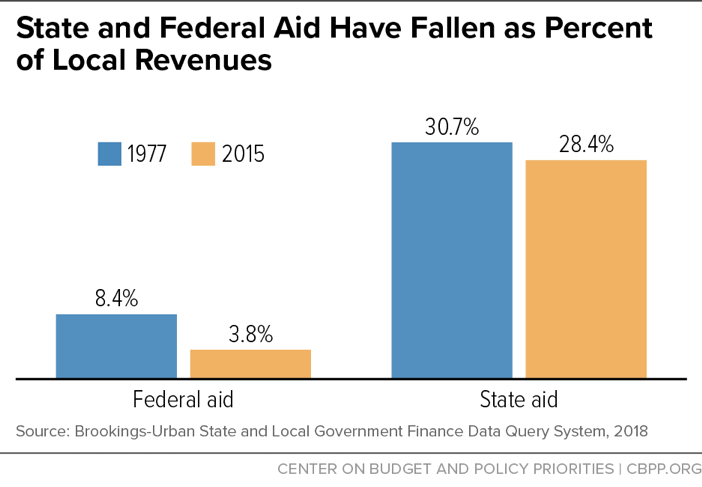

. This marginal tax rate means that. Plus localities can add up to an additional. These taxes at 236 percent are a significant source of revenue.

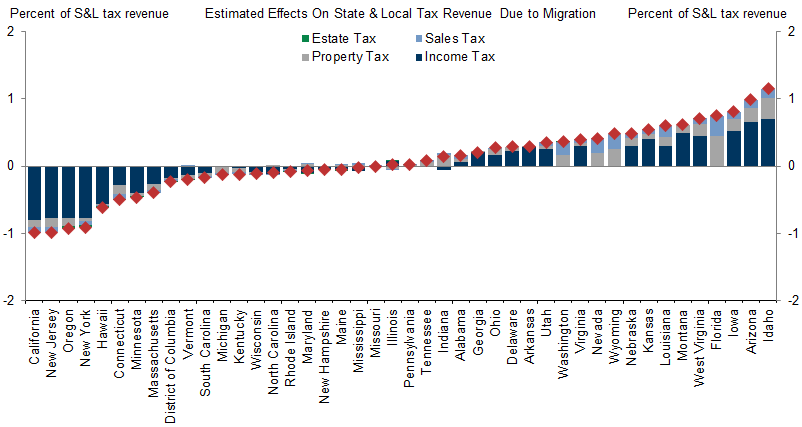

State levy is 485 but mandatory 1 local sales tax and 025 county option sales tax are added to the state tax for a 61 total rate. State levy is 485 but mandatory 1 local sales tax and 025 county option sales tax are added to the state tax for a 61 total rate. On average the lowest-income 20 percent of taxpayers face a state and local tax rate more than 50 percent higher than the top 1 percent of households.

Two cities Bessemer and Birmingham levy an income tax of 1. Reporting and tax rules may apply to the asset. If you make 70000 a year living in the region of Colorado USA you will be taxed 11001.

But theres a bit of good news herethe more closely related to the decedent someone is the less of a tax rate theyll pay. Kansas common law marriage is a legally recognized marriage between two people who live together in Kansas without a marriage license or religious ceremony. Tax resulting from the death transfer.

Long-term capital gains are taxed at a rate of 0 15 or 20. Three cities and one county. Federal Reserve of Kansas City President Esther George says shes undecided on a 50 or 75 basis-point rate hike at Jackson Hole.

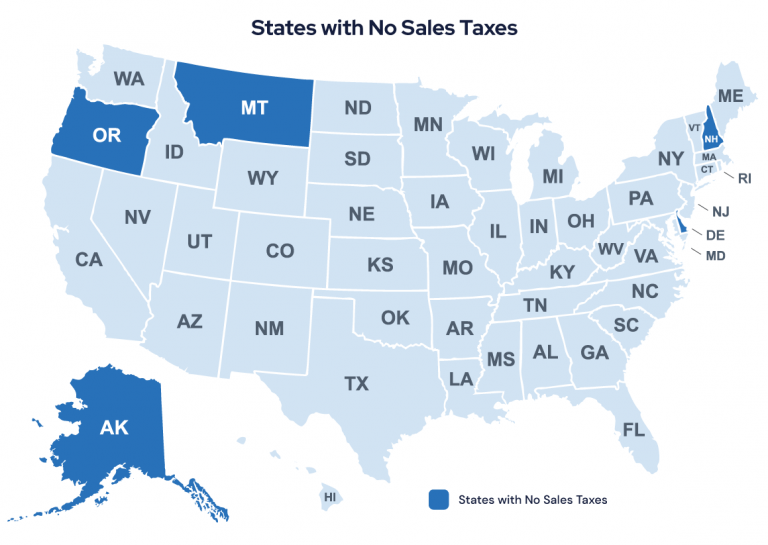

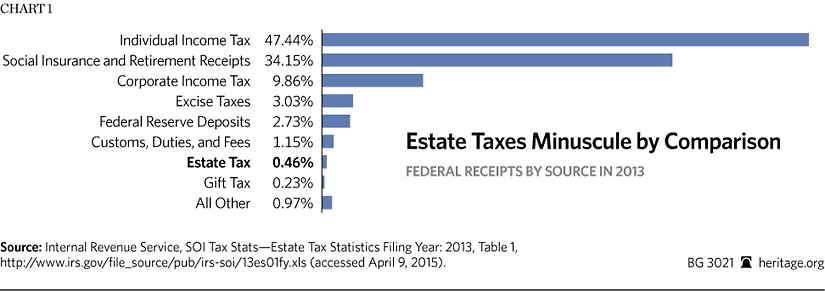

In addition to the federal estate tax with a top rate of 40 percent some states levy an additional state estate tax or state inheritance taxTwelve states and the District of Columbia impose estate taxes and six impose state inheritance taxes. Impose estate taxes and six impose inheritance taxes. Inheritance and Estate Tax and Inheritance and Estate Tax Exemption.

Each state has its own tax rates and criteria. Many municipalities have both a local and state sales tax. In economics the Laffer curve illustrates a theoretical relationship between rates of taxation and the resulting levels of the governments tax revenueThe Laffer curve assumes that no tax revenue is raised at the extreme tax rates of 0 and 100 and that there is a tax rate between 0 and 100 that maximizes government tax revenue.

The nationwide average effective state and local tax rate is 114 percent for the lowest-income 20. The tax is imposed on both residents and nonresidents who work in these locations. Alabama has four local taxing jurisdictions.

Tax season takes a bigger bite out of retirement in some states than in othersSeveral states dont have their own income tax but retirees also need to consider sales taxes property taxes and whether there are taxes on Social Security retirement distributions estates and inheritanceThat bigger picture is what makes some states retirement havens and others a drain on retiree. In addition to the federal estate tax with a top rate of 40 percent some states levy an additional estate or inheritance tax. Plus localities can add up to an additional.

Maryland is the only state to impose both a state estate tax rate and a state inheritance tax rate. Learn more about common law marriages in the state of Kansas. Maryland is the only state to impose both.

Alabama Mississippi and South Dakota apply the full sales tax rate on groceries which can hurt seniors. Macon County imposes a 1 tax as well. For instance the inheritance tax rate is as much as 18 in Nebraska so a beneficiary might owe the government 18000 if they inherited a 100000 account.

Based on earned wages Social Security benefits retirement plan withdrawals and other types of. Tax Rate Ranges Short-term capital gains can be taxed at a rate from 10 to 37 depending on your income tax bracket. Most states have been moving away from estate or inheritance taxes or have raised their exemption levels as.

This calculator estimates the average tax rate as the federal income tax. Your average tax rate is 1198 and your marginal tax rate is 22. Such rights include inheritance rights rights to take decisions on behalf of the other etc.

The United States does not impose inheritance taxes on the beneficiarys receipt of a bequest therefore there is no US. Gadsdens rate is 2. The last option available for sellers to avoid taxes is to pass off the property as an inheritance and pay inheritance tax instead.

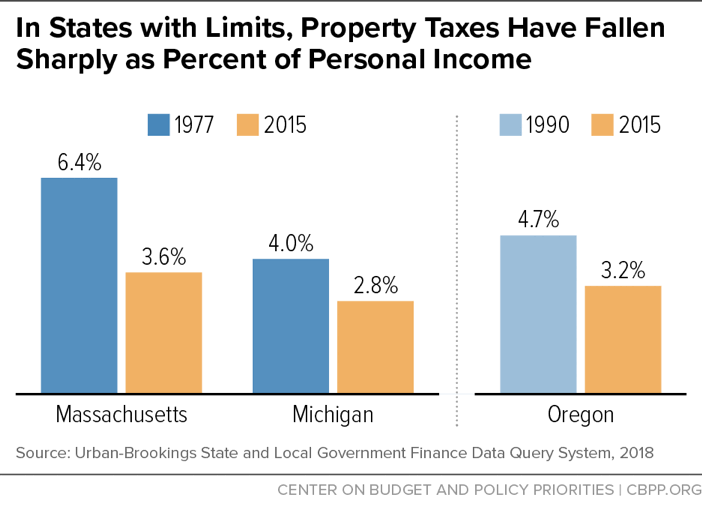

State Limits On Property Taxes Hamstring Local Services And Should Be Relaxed Or Repealed Center On Budget And Policy Priorities

State Taxes For Retirees Social Security Pensions Military

South Carolina Tax Rates Rankings Sc State Taxes Tax Foundation

Health And Hospital Expenditures Urban Institute

State Death Tax Is A Killer The Heritage Foundation

State Death Tax Is A Killer The Heritage Foundation

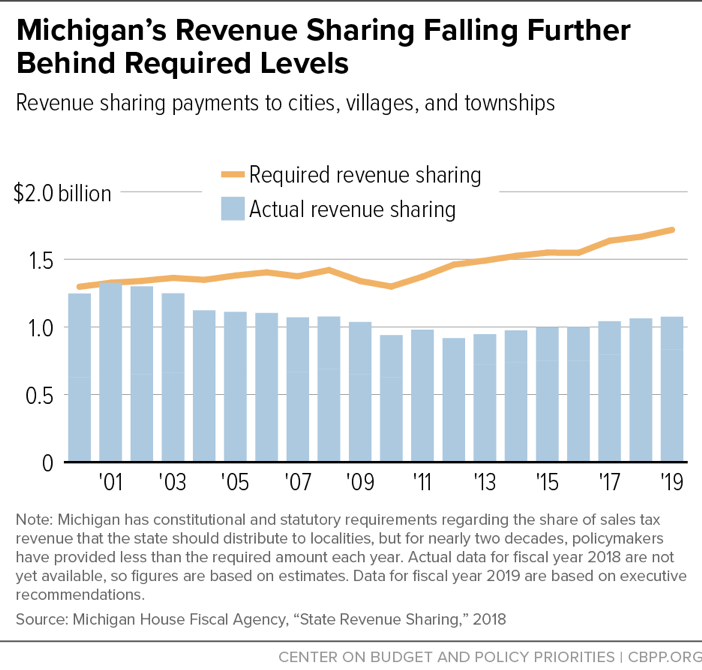

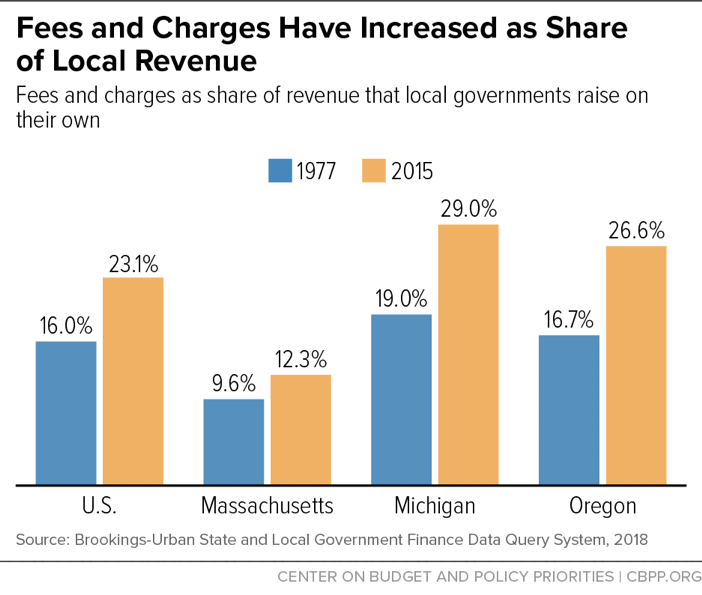

State Limits On Property Taxes Hamstring Local Services And Should Be Relaxed Or Repealed Center On Budget And Policy Priorities

State Limits On Property Taxes Hamstring Local Services And Should Be Relaxed Or Repealed Center On Budget And Policy Priorities

Health And Hospital Expenditures Urban Institute

South Carolina Tax Rates Rankings Sc State Taxes Tax Foundation

3 12 106 Estate Tax Returns Paper Correction Processing Internal Revenue Service

Trump Voters Could Be Key To Kansas Democrat Keeping Her Job Bloomberg Government

State Limits On Property Taxes Hamstring Local Services And Should Be Relaxed Or Repealed Center On Budget And Policy Priorities

No Taxation Without Emigration Briggs

State Taxes For Retirees Social Security Pensions Military

State Limits On Property Taxes Hamstring Local Services And Should Be Relaxed Or Repealed Center On Budget And Policy Priorities

State Limits On Property Taxes Hamstring Local Services And Should Be Relaxed Or Repealed Center On Budget And Policy Priorities